Refinance Your Home ‘Orrstown Bank.

A mortgage is a debt instrument, secured by the collateral of defined real estate residential or commercial property, that the customer is obliged to pay back with a predetermined set of payments. I have actually obtained a whole lot of inquiries recently regarding mortgage refinance requirements, but I believe I could help. You just utilize the earnings to pay off credit cards, medical expenses, a second home mortgage or any high-interest loans. Purchase a house utilizing the HECM for Purchase program. Money out refinancing can enable you to turn that equity into money when you have equity in your house. These charges usually include escrow and title fees, document preparation charges, title search and insurance, loan origination fees, flood certification, and recording fees. In specific instances, the proposed policies will also affect the federal work tax liabilities and other obligations of customers of the CPEO. With a reverse home mortgage, the customer gets payments from the loan provider and does not have to make payments back to the lender so long as she or he resides in the home and continues to fulfill his/her fundamental obligations, such as payment of taxes and insurance.

If refinancing is best for your present monetary circumstance, your Mortgage Loan Producer will help you determine. The bank or mortgage loan provider will usually lend about 80 percent of the rate of the home. If you have an adjustable rate home loan (ARM) that is due, are wanting to get a lower rates of interest on your existing fixed-rate home loan, or want to extend your repayment time or pay off other financial obligation, now may be the perfect time for you to re-finance your mortgage loan. Simply puts, if the rate were 3.625% without squander, anticipate the cash out refinance rate to be 3.75% or 3.875%, all else being equal. Mortgage • We mortgaged our home to start Paul’s organisation • Should you mortgage the household home? I’ve discovered a great deal about washington state mortgage rates refinance that I want to share. • It obtained so heavily that the greater part of its peacetime profits was mortgaged to service and repay its Longman Company Dictionarymortgagemort gage1/ ˈmɔːgɪdʒˈmɔːr-/ noun countableFINANCEBANKINGPROPERTY a legal arrangement where you borrow cash from a financial institution in order to buy land or a home, and you pay back the money over a period of years.

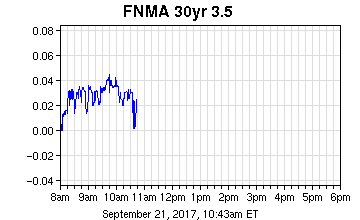

After evaluating your credit report, contact a home loan lender or mortgage broker to borrow loan to purchase the home or home. Have a look at the chart listed below to see the refinance rates in your location. Some loan providers require payment completely of any outstanding balance at the end of the duration. When a payment is made after its due date or courtesy duration, the charge a customer need to pay. In many cases, the payment schedule calls for equivalent payments that will settle the whole loan within the loan period. The set-aside” minimizes the quantity of funds you can get in payments. Let’s check into free mortgage refinance calculator. At Bank of Hawaii, a mortgage loan officer can assist you compare loan programs that best fit your monetary requirements. They will consider what the current rate of interest are and your present monetary situation.

Many people don’t have sufficient money in savings to buy a home, so they make a deposit of 20 percent approximately and obtain the rest. Bank of Internet U.S.A was a huge assistance in this procedure and should be applauded for Bank of Web USA service and focus on my needs during this refinance. The Fact in Loaning Act enables three days from the day the account was opened to cancel the credit line if the house involved is a principal residence. The majority of millennial households’ wealth comes from physical assets, such as cars and trucks, homes and organisations. It is used by the debtor as a temporary financing solution while altering to another monetary arrangement for the land protected by the mortgage; and. When you get a rate and term re-finance, you change your mortgage with a loan sporting a lower interest rate, and for approximately the very same term.

The lender’s percentage of yearly return on real funds lent, assuming that the loan will be paid in full at maturity. A quasi government firm created by Congress that purchases and offers domestic loans. Utilize our refinance calculator to evaluate your existing circumstance. These various meanings may provide difficulties when collecting loan origination information and comparing the various reporting requirements and analyses of exactly what makes up an application” for functions of state, federal, and MCR purposes. Refinancing your existing home loan balance can perhaps save you cash by either reducing your rate of interest or reducing your loan term. Copies of property details: This includes statements for accounts that hold loan for closing expenses, statements for savings, statements for inspecting and 401( k) accounts, and investment records for mutual funds or stocks.

Breaking even requires making enough payments at the lower payment to conserve more than the cost of refinancing. A federal law requiring lenders to offer home mortgage debtors with information on known or estimated settlement expenses. For purchase and refinance applications taken before October 3, 2015, clients get a HUD-1 Settlement Statement at closing that details the fees related to closing the loan. A special kind of protected loan where the purpose of the loan should be specified to the lender, to buy possessions that must be fixed (not movable) property such as a house or piece of farm land. The part of a property owner’s month-to-month mortgage payment that is held by a loan provider or servicer to pay taxes and insurance coverage, consisting of mortgage insurance and hazard insurance, in your place.

These computations presume that clients’ rate of interest will not alter with time, that customers make all payments on-time, which no loans will be prepaid. Fixed-rate loans are so simple that you can determine home loan payments and the payoff procedure by yourself (spreadsheets and online design templates make it much easier). In these instances lots of property owner refinance into a shorter-term loan that will not extend the time they will make mortgage payments, such as a 20 or 15 year home mortgage (which oftentimes likewise provide lower rates than 30-year loans). House owners need to have at least 20 percent equity in their the home of get approved for a brand-new loan without paying private home loan insurance Including PMI to the cost of a new loan could negate the benefit of a refinance.

Get more responses to your automobile loan concerns on our Vehicle loan FAQ page. The service, company and lender company of the credit card is Elan Financial Providers. Alternatively, there’s the second home loan route, either a HELOC or house equity loan. Word History: In early Anglo-Norman law, residential or commercial property promised as security for a loan was usually held by the creditor until the debt was paid back. A type of insurance coverage that covers repair work to specified parts of a home for a particular period of time. The Federal Real estate Finance Company estimates more than 429,000 borrowers across the country stay qualified for a HARP re-finance More than 3.3 million borrowers have actually already refinanced their houses through the program, which has actually been extended a number of times but will end on Dec